Latest Episodes

Rentit: A marketplace for urgent needs

On this episode of Built in Africa, we'll be looking at how Nigerian rental marketplace, Rentit , helps people rent goods and cut down...

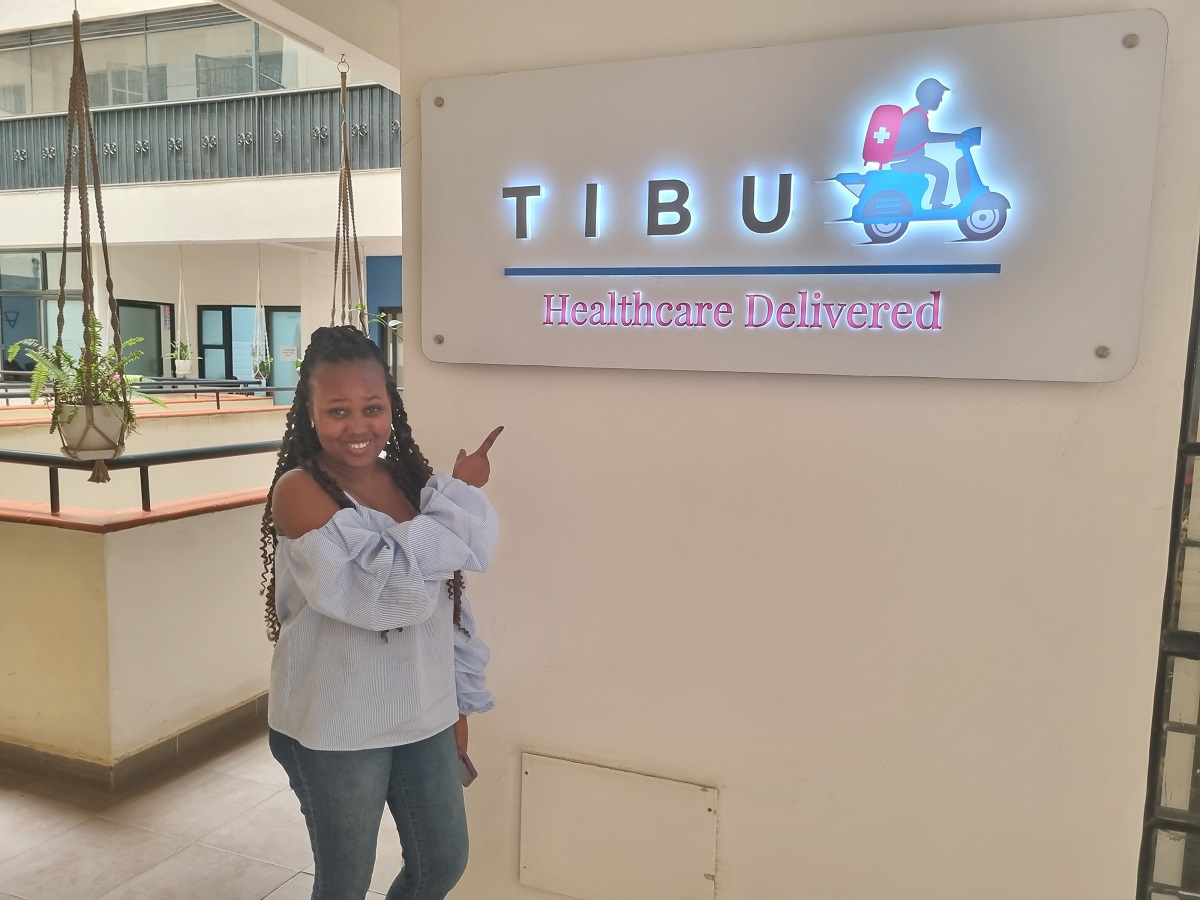

Tibu Health: Worldclass clinic on a backpack

To mark the return of Built in Africa, we spotlight Tibu Health a startup looking to take away the long queues and inefficiencies that...

0

Siltech: Fostering a cleaner Africa through Electric Vehicle production

In this episode of Built in Africa, we examine how Nigerian e-mobility company, Savenhart Technology Limited (Siltech), wants to foster a cleaner Africa through...

0

Enye: Upscaling budding engineers, connecting them to startup founders

This episode is brought to you by Whogohost WordPress Hosting. Visit builtin.africa/whogohost and use coupon code BUILTINAFRICA to get 25% off on any annual...

0

APEX Medical Laboratories: Helping Malawians get specialised healthcare services

This episode is brought to you by Whogohost WordPress Hosting. Visit builtin.africa/whogohost and use coupon code BUILTINAFRICA to get 25% off on any annual...

0

AfroCharts: Indigenous African music streaming platform

This episode is brought to you by Whogohost WordPress Hosting. Visit builtin.africa/whogohost and use coupon code BUILTINAFRICA to get 25% off on any annual...